Women need to manage their finances and term life insurance just as much as men. Why not? Because, women have a higher life expectancy than men, which gives women more reason to get term life insurance. Also, it plays a massive help in women-specific organ cancers like breast and cervical cancer.

Long-term goals can be a huge reason for such investments. The post-retirement life is pretty much sorted and not cluttered with issues or confusion. In all the unfortunate times, it is a very valuable investment that you might not be able to see as a short-term benefit.

There are several applications that might help you to manage your finances and your term life insurance quotes being a working woman. Such useful applications are as follows.

Ellevest: Investing for women

Ellevest’s motto is to give a personalized approach to people for their investments because they understand that people can have personal goals with their hard-earned money. They also state that they are on a mission to get more money in the hands of women.

They provide the facility of “money coaching,” where they teach and talk about women’s needs and a female approach to investing the money in small group sessions and workshops. In addition, certifying financial support is provided to help to clear the vision of these women.

Several digital investing memberships are available that help with benefits like personalized portfolios, coaching discounts, etc.

Download for Android

Download for iOS

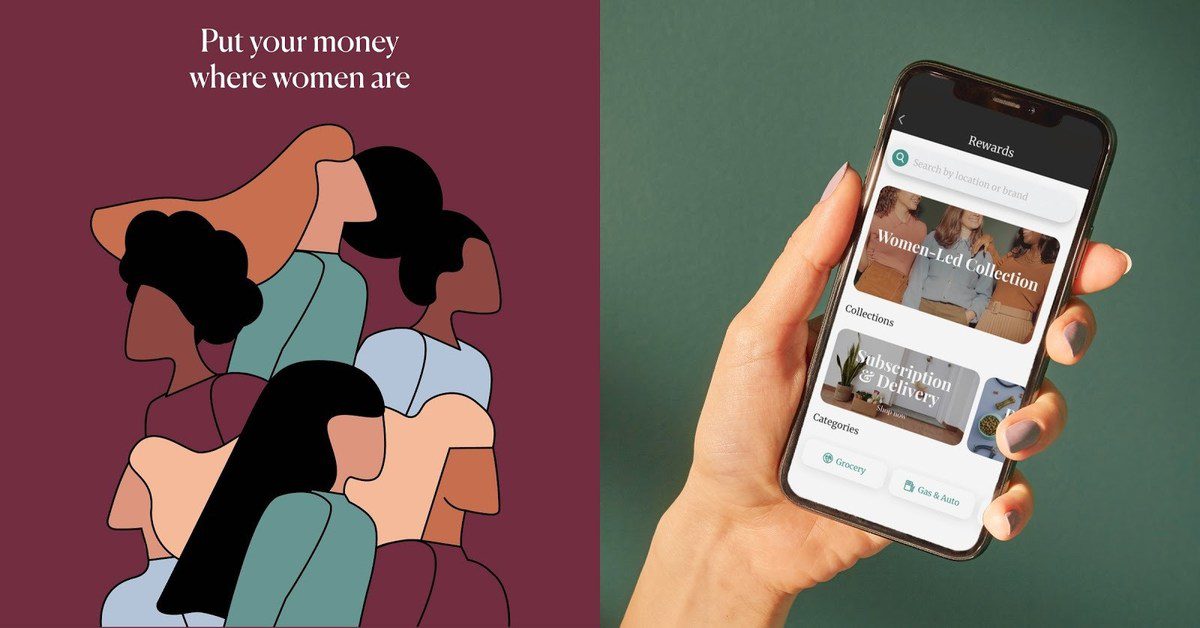

Peapack Private

The wealth management division, Peapack Private, provides comprehensive financial, tax, fiduciary, and investment advice to individuals, families, privately-held businesses, family offices, and not-for-profit organizations. They help their clients set and achieve their goals by developing solutions specifically designed and implemented for them.

They have a very high profile and reputed team of people who are in wealth management leading the pact. These include profiles like David M. Collum, John P. Babcock, Jefferey Fisher, and many more.

Download for Android

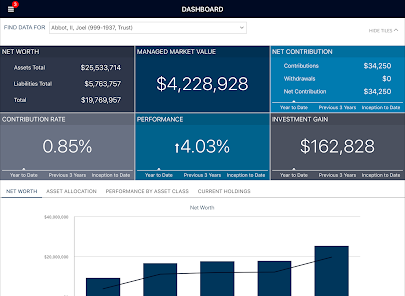

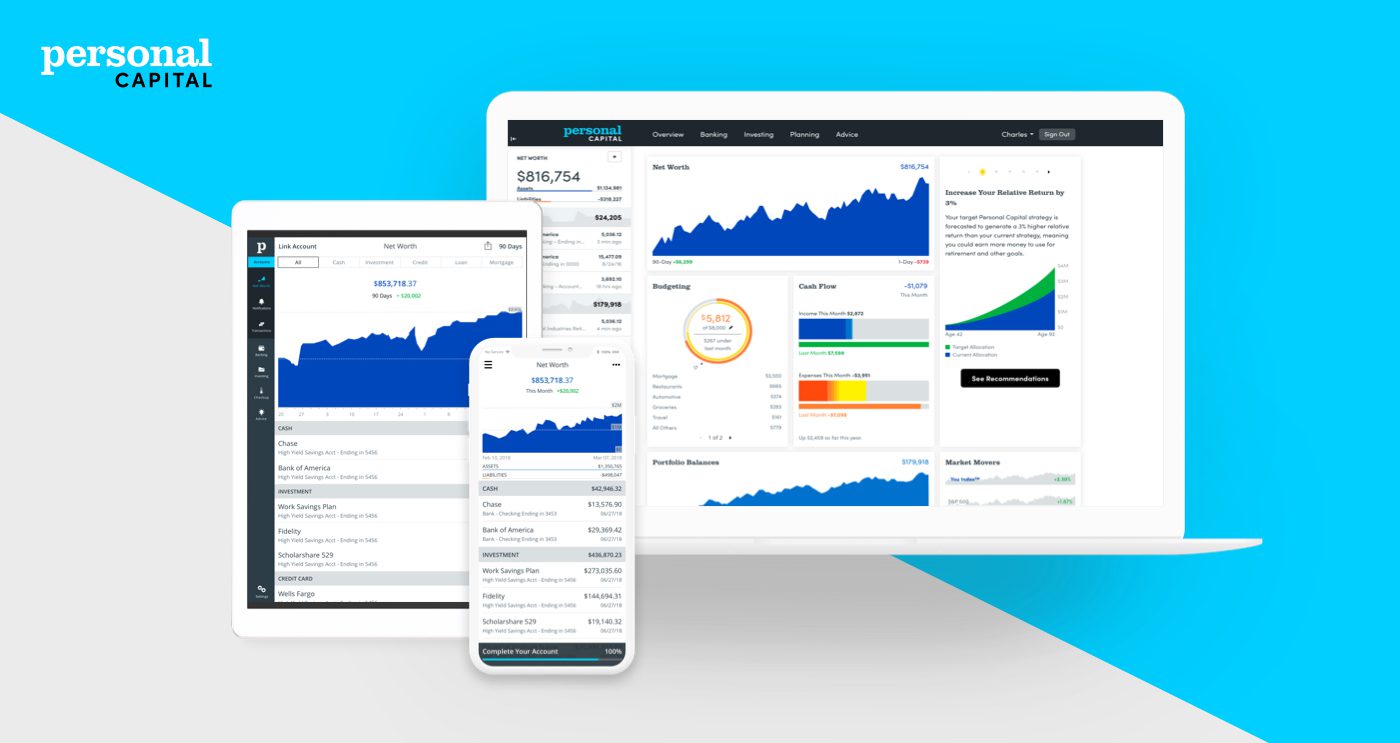

Personal Capital: Finance

Personal capital is another platform that can help make your finances super easy. It helps to put up all your money accounts in one place, which makes your work easy. It also gives you a retirement readiness score in less than a few minutes.

It also provides software called “fee analyzer” that helps find the hidden fees wherever found, absolutely free of cost. The application/website required a minor sign-up. The application is rated 4.7 stars on the apple store.

Download for Android

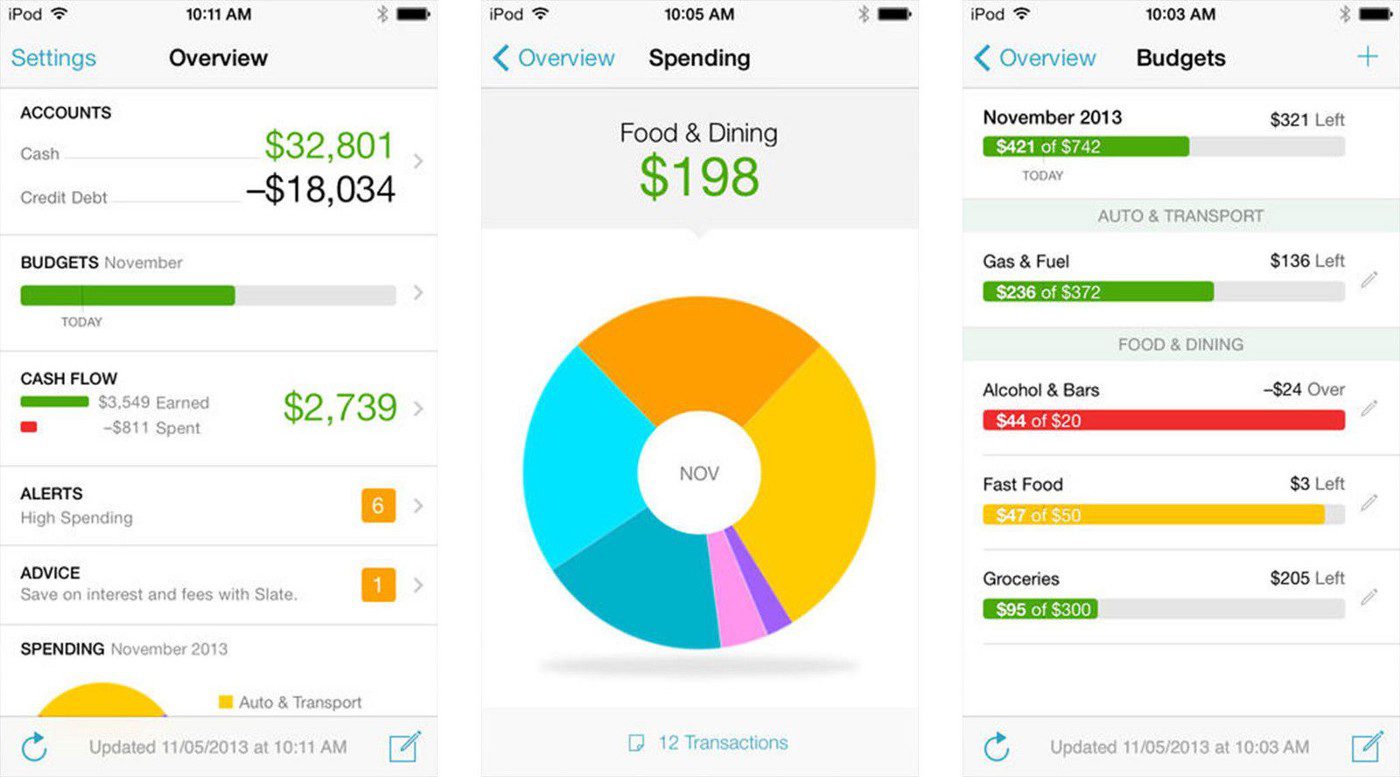

Mint: Budget & Track Bills

Mint has been considered one of the best applications to manage finances and budgets since 2006. The utmost priority of an app like mint is to maintain its security just like its parent company Intuit. They have heavy security measures with strong encryptions.

It also allows you to track your investments, keep a check on your portfolio, and compare it to the existing one. It can also manage your brokerage account if there are any. However, there is one con that’s observed as an issue by a major population, as the application is free, it has a lot of advertisements that might interrupt your experience.

Download for Android

Healthcare of America

Healthcare of America is a leading provider of low-cost health insurance quotes. More than 15 million people from all walks of life — small business owners and the self-employed, retirees, students, and people whose jobs don’t provide health insurance — have used this site to learn about health insurance, compare plans, get free health plan quotes, and lower their healthcare costs.

They believe that investing in long-term insurance can be confusing so they believe in providing a long professional guide who can help you throughout the process and show you the right path to do so.

Conclusion

One of the huge benefits of long-term insurance is the peace of mind; whenever a certainty might arrive, you must be ready to face it with full preparations and not be worried about “what might happen.” Another benefit can be that it serves as an inheritance for your loved ones, helping them stay stable in uncertain times.

Most of the platforms for investments are good for both men and women, but there are some which are very specifically built for women like Ellevest and can be looked upon. Moreover, Happy investing, folks!