The Milken Family Investment Company, founded by Michael Milken, is a leading financial services firm that provides asset management and advisory services to high-net-worth individuals, families, and institutions. Michael Milken, who is best known for his involvement in insider trading, used his family’s investment company to commit financial fraud and securities violations in the 1980s. Despite the controversy surrounding Milken and his legacy, the Milken Family Investment Company has continued to provide strong returns to its clients and remains a leader in the financial service industry.

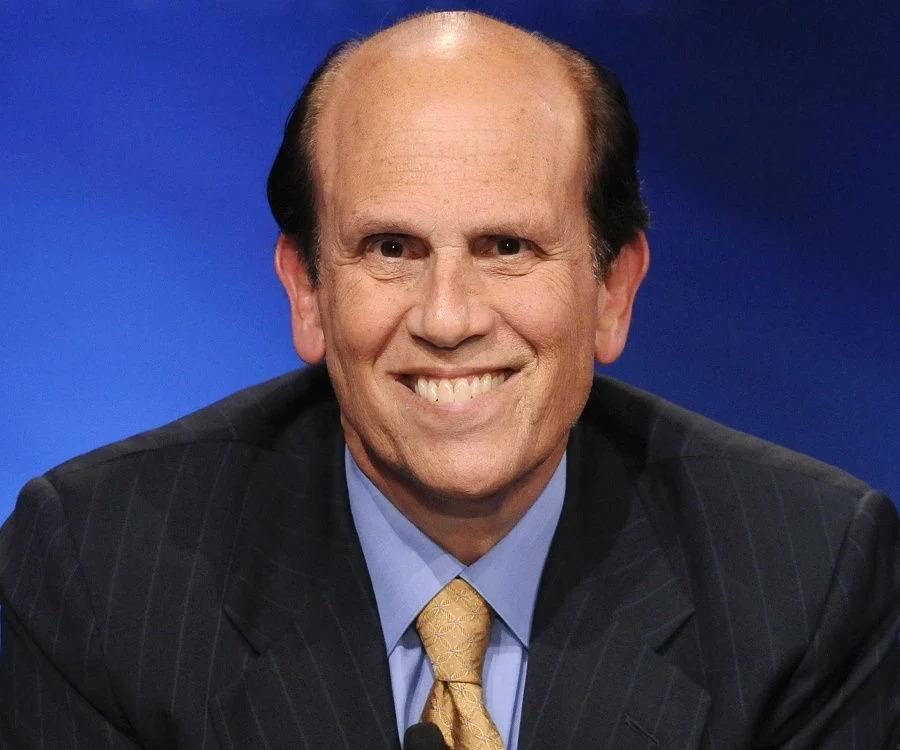

Michael Milken and His Career

Michael Milken was born in California in 1946. He earned a degree in business administration from the University of Pennsylvania’s Wharton School in 1968 and later received his MBA from the same institution. Milken began his career as a securities analyst at Drexel Firestone, a subsidiary of Drexel Harriman Ripley. He quickly rose through the ranks, becoming a partner in 1975.

In the 1980s, Milken played a key role in the rise of junk bonds, high-yield debt securities that offered higher returns but were considered riskier than traditional bonds. He worked at Drexel Burnham Lambert, a leading investment bank at the time, where he led the firm’s high-yield bond department. Milken’s innovative financing techniques helped to fund many of the era’s biggest corporate takeovers, including the leveraged buyout of RJR Nabisco.

Despite his success, Milken was known for his aggressive business tactics and was often criticized for his role in the rise of junk bonds. He was also investigated by the Securities and Exchange Commission (SEC) for insider trading.

Michael Milken and Insider Trading

Michael Milken and Insider Trading have become a cautionary tale for those seeking to take advantage of privileged information. Michael Milken was investigated by the SEC in the late 1980s for insider trading. He was accused of using inside information to trade on several companies, including Revlon, Texaco, and Hilton Hotels. Milken denied the allegations and argued that he was not aware that the information he used was confidential.

However, after a lengthy investigation, Milken was indicted on 98 counts of racketeering, securities fraud, and other charges. He faced up to 28 years in prison and millions of dollars in fines.

In 1990, Milken struck a plea deal with the government, agreeing to plead guilty to six counts of securities fraud and pay $600 million in fines and penalties. He also agreed to cooperate with prosecutors in their investigation of other insider trading cases. Milken was sentenced to 10 years in prison but was released after serving less than two years.

Milken Family Investment Company

After his release from prison, Michael Milken founded the Milken Family Investment Company, a private investment firm focused on investing in innovative companies in the healthcare, education, and technology sectors. The company was founded in 2011 and has since invested in several successful startups, including Uber, Snapchat, and Lyft.

The Milken Family Investment Company typically keeps its holdings for an extended period of time and looks for businesses that have a high potential for growth in order to achieve the highest possible return on their investments. In addition, the Milken Family Investment Company looks for businesses that are already successful. In addition, the organization places a significant amount of emphasis on the significance of social impact and has made investments in businesses that are aiming to address concerns such as accessibility to healthcare and sustainability. Additionally, the organization places a significant amount of focus on the significance of social impact.

Michael Milken plays an active role in the firm, serving as chairman of the investment committee. The company has also attracted several high-profile investors, including Jeff Bezos, the founder of Amazon.

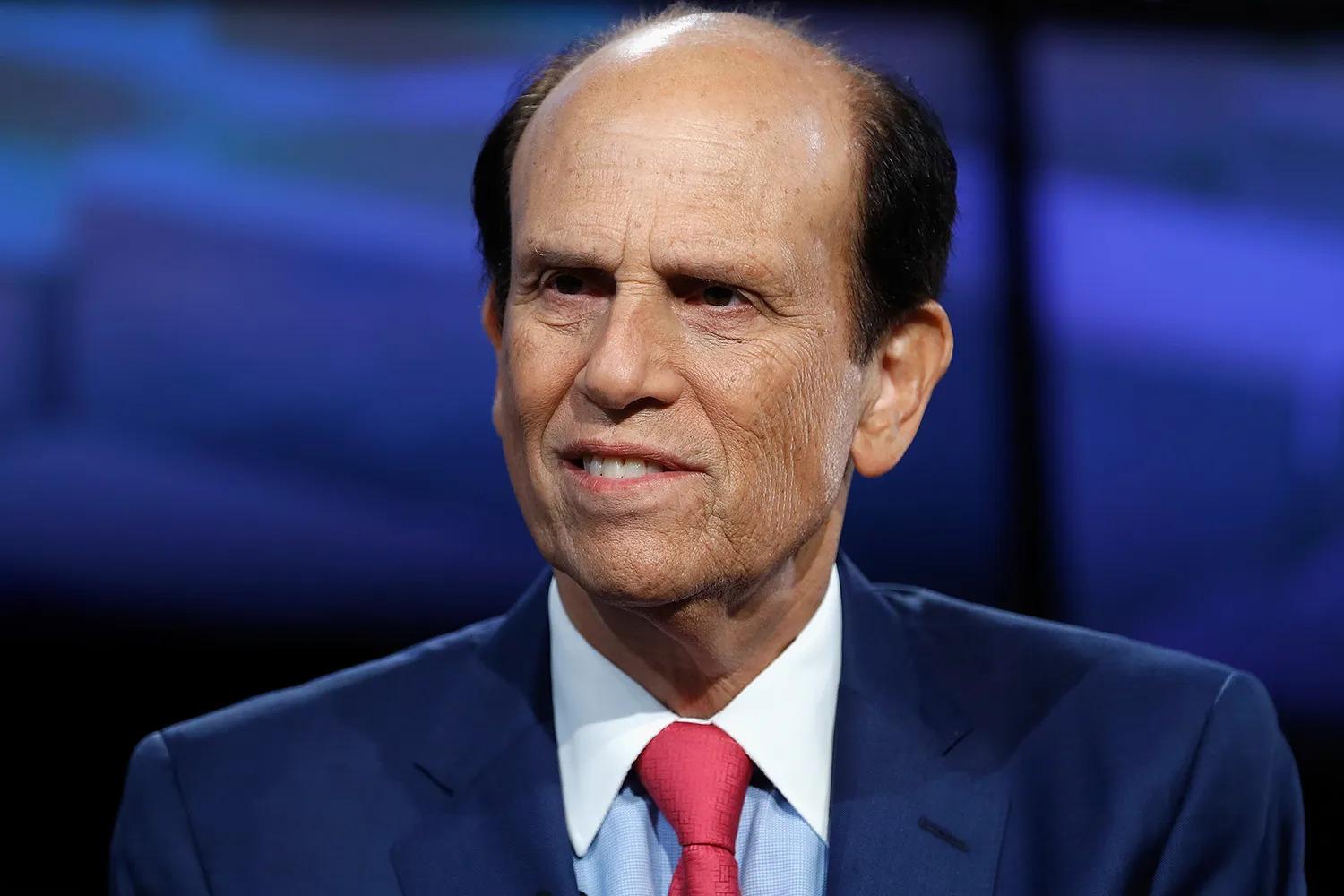

Legacy of Michael Milken’s Insider Trading

Michael Milken’s involvement in insider trading has had a significant impact on the financial industry. The case against Milken was one of the largest insider trading cases in history and led to increased scrutiny of Wall Street practices. It also led to the downfall of Drexel Burnham Lambert, which filed for bankruptcy in 1990.

Some argue that Milken’s innovative financing techniques helped to spur economic growth in the 1980s and paved the way for the high-tech boom of the 1990s. Others, however, believe that his actions were unethical and contributed to destabilizing the financial markets.

Despite his controversial past, Michael Milken has become known for his philanthropic efforts. In 1982, he founded the Milken Family Foundation, a charitable organization that supports education and medical research. The foundation has provided more than $1 billion in grants and awards over the years.

Milken himself has also been actively involved in philanthropy, donating millions of dollars to causes such as cancer research and public health initiatives. He has also been a vocal advocate for social impact investing, arguing that investors have a responsibility to consider the broader social and environmental implications of their investments.

Who Is Involved In Michael Milken’s Insider Trading?

Ivan Boesky

Boesky was a prominent arbitrageur and investor who also engaged in insider trading. He was a client of Milken’s at Drexel and made millions of dollars through illegal trades based on insider information. Boesky eventually agreed to cooperate with investigators and provided information that led to Milken’s indictment.

Martin Siegel

Siegel was a mergers and acquisitions specialist at Kidder Peabody who also engaged in insider trading. He provided insider information to both Boesky and Milken and eventually pleaded guilty to insider trading charges and cooperated with investigators.

Dennis Levine

Levine was an investment banker at Drexel who also engaged in insider trading. He provided insider information to Boesky, Milken, and others, and eventually pleaded guilty to insider trading charges and cooperated with investigators.

Bruce Newberg

Newberg was a lawyer who worked for Drexel and provided insider information to Milken and others. He eventually pleaded guilty to securities fraud charges and cooperated with investigators.

Lowell Milken

Michael Milken’s younger brother, Lowell, was also involved in the scandal. He worked as a bond trader at Drexel and was accused of participating in insider trading and other illegal activities. However, he was not charged with any crimes and settled civil charges with the Securities and Exchange Commission (SEC) in 1991.

Conclusion

Michael Milken’s insider trading legacy has had a significant impact on the financial industry. While his innovative financing techniques helped to spur economic growth in the 1980s, his involvement in insider trading ultimately led to his downfall and the bankruptcy of Drexel Burnham Lambert. However, Milken has since become known for his philanthropic efforts and has been a vocal advocate for social impact investing. His story is a reminder of the importance of ethical business practices and the role that finance can play in creating positive social and environmental change.